Virginia Electric Car Tax Credit

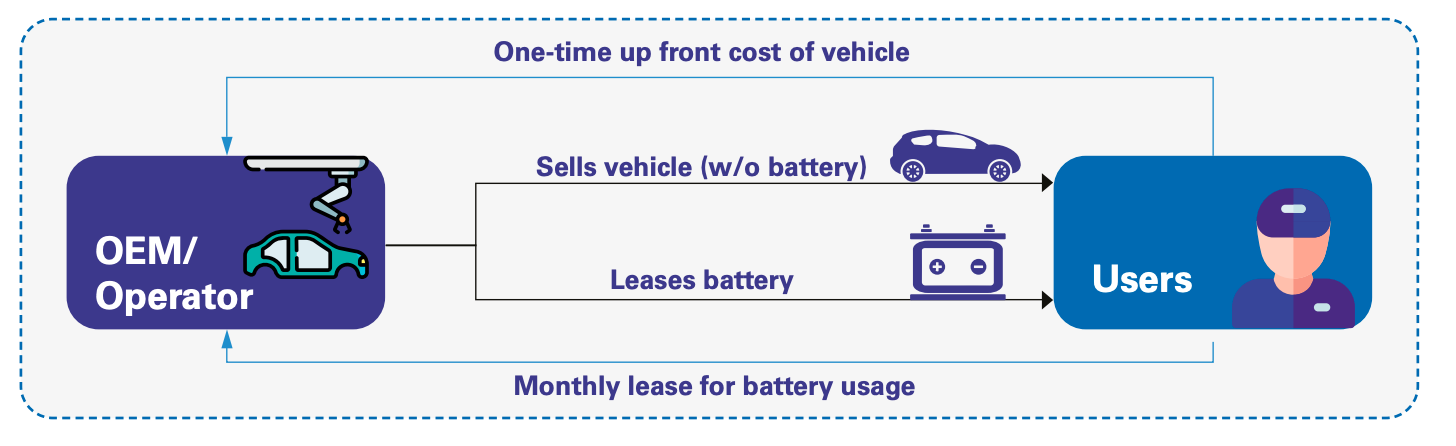

An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate.

Pin On Electric Vehicle Institute

This is not a refundable tax credit.

Virginia electric car tax credit. An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia. Review the credits below to see what you may be able to deduct from the tax you owe. Virginia lawmakers have put forward House Bill 469 which would allow for a 10 State tax refund on the purchase of an electric vehicle up to a 3500.

Virginia entices locals to go green by offering numerous time- and money-saving green driver incentives. State andor local incentives may also apply. A bill proposed in mid-January by Virginia House Delegate.

Virginia State and Federal Tax Credits for Electric Vehicles. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Why Do You Keep Saying Up To.

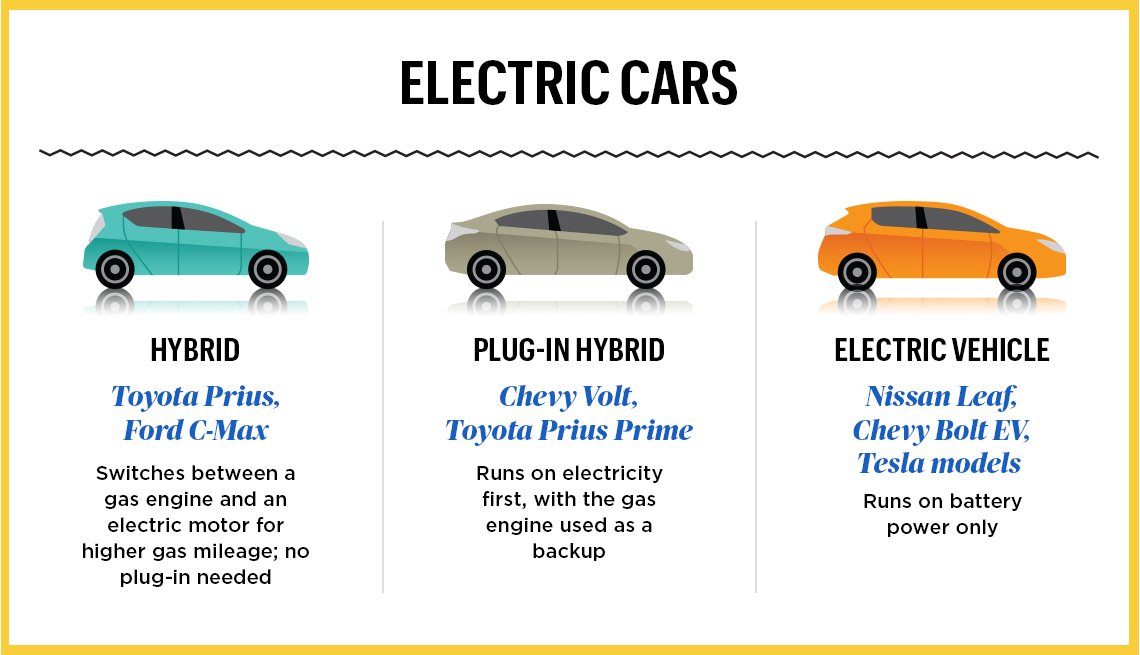

If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has at least five kilowatt-hours of capacity and uses an external charging source. Virginia is for loversand electric-car advocated had hoped that it would soon be for lovers of electric cars and plug-in hybrids too.

However this credit will be phased out after 200000 electric models have been sold by a given manufacturer in the United States. The amount of credit you are entitled to depends on the battery capacity and size of the vehicle. Visit FuelEconomygov for an insight into the types of tax credit available for specific models.

2500 tax credit for purchase of a new vehicle 1500 tax credit for lease of a new vehicle Select utilities may offer a solar incentive filed on behalf of the customer. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. If you purchased a Nissan Leaf and your tax bill was 5000 thats all you get at the end of the year.

The electric vehicle tax credit is worth up to 7500. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. EV-related legislation include electric vehicle tax credits incentives for charging equipment Plug-in vehicle parking spaces and bills to permit the installation of charging equipment at.

In short automakers that have met the threshold already would have access to a new 7000 tax credit for 400000 additional electric vehicles until a new phaseout period starts again. Drivers who currently own or who intend to purchase an electric vehicle EV in the near future should be aware that they may qualify for several tax credits and incentives at both the state and federal level. In its final form the program which would begin Jan.

In other words this only applies if your tax bill is worth 7500 or more. The fee is included with registration fees and must be paid at the time of original registration and each year at renewal. Virginia Department of Mines Minerals and Energy DMME in cooperation with the Departments of Environmental Quality Motor Vehicles and Taxation launched a summer 2020 Electric Vehicle Incentive Working Group.

A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500. The credit amount will vary based on the capacity of the battery used to power the vehicle. An additional 2000 rebate would be available for certain income qualified individuals.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Green Driver State Incentives in Virginia. These perks include alternative fuel vehicle AFV emissions test exemptions for electric cars and hybrids high occupancy vehicle HOV lane access for clean-fuel vehicles state and federal tax.

The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax. The focus of this effort the feasibility of an electric vehicle rebate program for Virginia under HB717. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

Electric Cars Pros And Cons Of The Chevy Bolt Ev And Tesla Model 3

Pin On Electric Vehicle Institute

Electric Cars In India Only 10 15 Penetration Of Electric Cars Is Expected By 2030 In India Report Auto News Et Auto

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

Ford Wants To Build Electric Vehicles In China Electric Cars Ford Focus Electric Vehicles

Electric Vehicles Virginiaev Org

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Your State Might Be Offering These Awesome Perks For Evs And You Don T Even Know It How To Create Infographics Incentive Infographic

Cost Of Running An Electric Car Buyacar

Harley Davidson Limited Time Electric Vehicle Incentive Harley Davidson Harley Davidson Stock Motorcycle Dealer

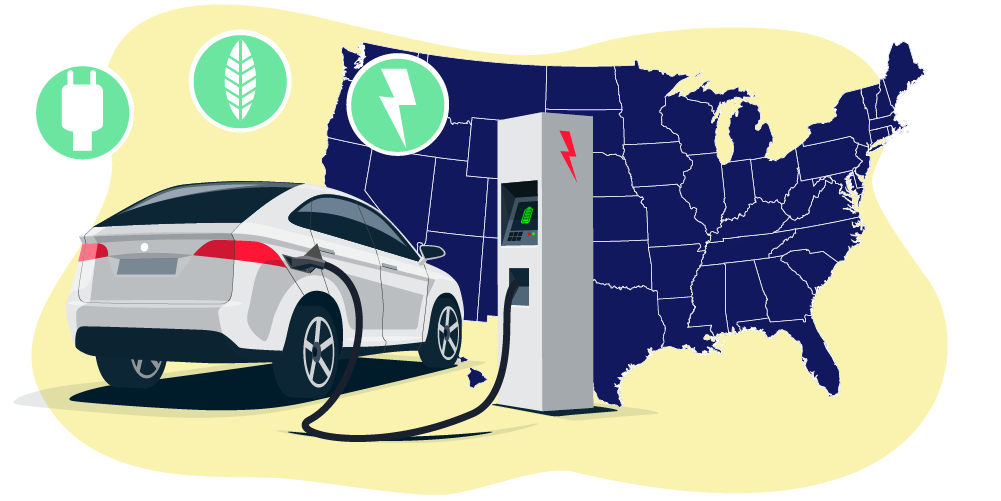

Top States For Adoption Of Electric Vehicle Infrastructure Quotewizard

Electric Cars Are Better For The Planet And Often Your Budget Too In 2021 Nissan Leaf Electric Cars Electric Cars Car Cost

Post a Comment for "Virginia Electric Car Tax Credit"